|

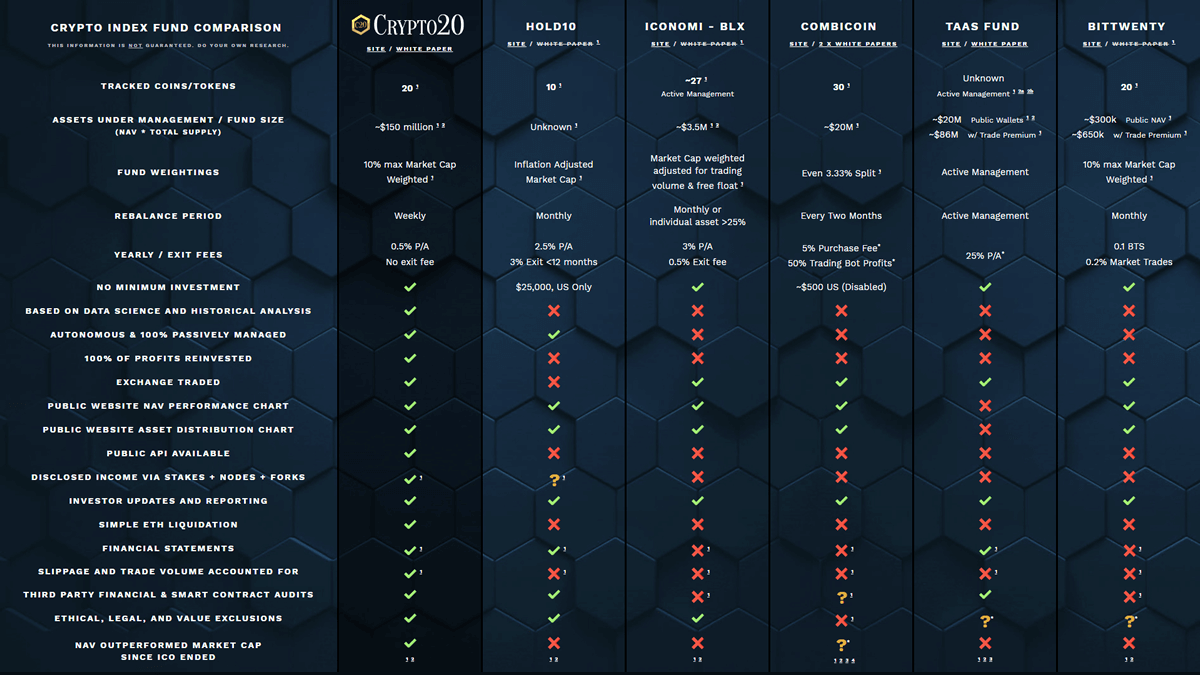

Crypto Index Fund Comparison

This information is not guaranteed. Do your own research. |

Coinbase Index

|

Iconomi - BLX

|

|||||

|

Tracked Coins/Tokens |

20 1 |

4 1 |

10 1 |

~27

1

|

30 1 |

20 1 |

|

|

Assets Under Management / Fund Size |

Unknown 1 |

Unknown 1 |

~$20M 1 |

||||

|

Fund Weightings |

10% max Market Cap Weighted 1 |

Market Cap Weighted 1 |

Inflation Adjusted |

Market Cap weighted adjusted for trading volume & free float 1 |

Even 3.33% Split 1 |

Active Management |

10% max Market Cap Weighted 1 |

|

Rebalance Period |

Weekly |

Annually |

Monthly |

Monthly or |

Every Two Months |

Active Management |

Monthly |

|

Yearly / Exit Fees |

0.5% P/A No exit fee |

2% P/A |

2.5% P/A 3% Exit <12 months |

3% P/A 0.5% Exit fee |

0.1 BTS 0.2% Market Trades |

||

|

No Minimum Investment |

|

$10,000, US Only |

$25,000, US Only |

|

~$500 US (Disabled) |

|

|

|

Based on Data Science and Historical Analysis |

|

|

|

|

|

|

|

|

Autonomous & 100% Passively Managed |

|

|

|

|

|

|

|

|

100% of profits reinvested |

|

|

|

|

|

|

|

|

Exchange Traded |

|

|

|

|

|

|

|

|

Public Website NAV Performance Chart |

|

|

|

|

|

|

|

|

Public Website Asset Distribution Chart |

|

|

|

|

|

|

|

|

Public API Available |

|

|

|

|

|

|

|

|

Disclosed Income via Stakes + Nodes + Forks |

|

|

|

|

|

||

|

Investor Updates and Reporting |

|

|

|

|

|

|

|

|

Simple Smart Contract ETH Liquidation |

|

|

|

|

|

|

|

|

Financial Statements |

|

|

|||||

|

Slippage and Trade Volume Accounted For |

|

||||||

|

Third Party Financial & Smart Contract Audits |

|

|

|

||||

|

Ethical, Legal, and Value Exclusions |

|

|

|

|

|||

|

NAV Outperformed Market Cap |

|

|

|

|

|